Stop Living Paycheck to Paycheck — Boost Your Money in 7 Days with AI

🚀 Start saving, budgeting smarter, and building credit — all in just 7 days. 100% free, no card needed

💸 No Credit Card. No Spam. Just Results.

😩 Tired of feeling broke every month? Get daily AI tips to turn your money around. Sign up free today

The #1 Free Finance Reset Plan for Young Canadians

Break the paycheque-to-paycheque cycle in just 7 days. Personalized AI tips. Real results. Zero cost.

Trusted by busy students, desk workers, and new immigrants across Canada. Free. Friendly. Designed for you.

What You will Get in 7 Days

Track Spending

“Where does all my money go?” We’ll show you — automatically. Start with an AI-powered snapshot of your real spending habits.

AI BUDGETING

Forget budget stress. Use AI to build a realistic weekly budget tailored to your actual income and lifestyle — no spreadsheets needed.

Cut Hidden Costs

One forgotten subscription = easy savings. Find and cancel recurring charges you didn’t even remember — with AI’s help.

50/30/20 RULE

How much should you spend, really? Use AI to apply the golden budgeting rule based on your real numbers.

BOOST CREDIT SCORE

Check it. Understand it. Improve it. Use free Canadian tools to raise your score, starting with one smart action.

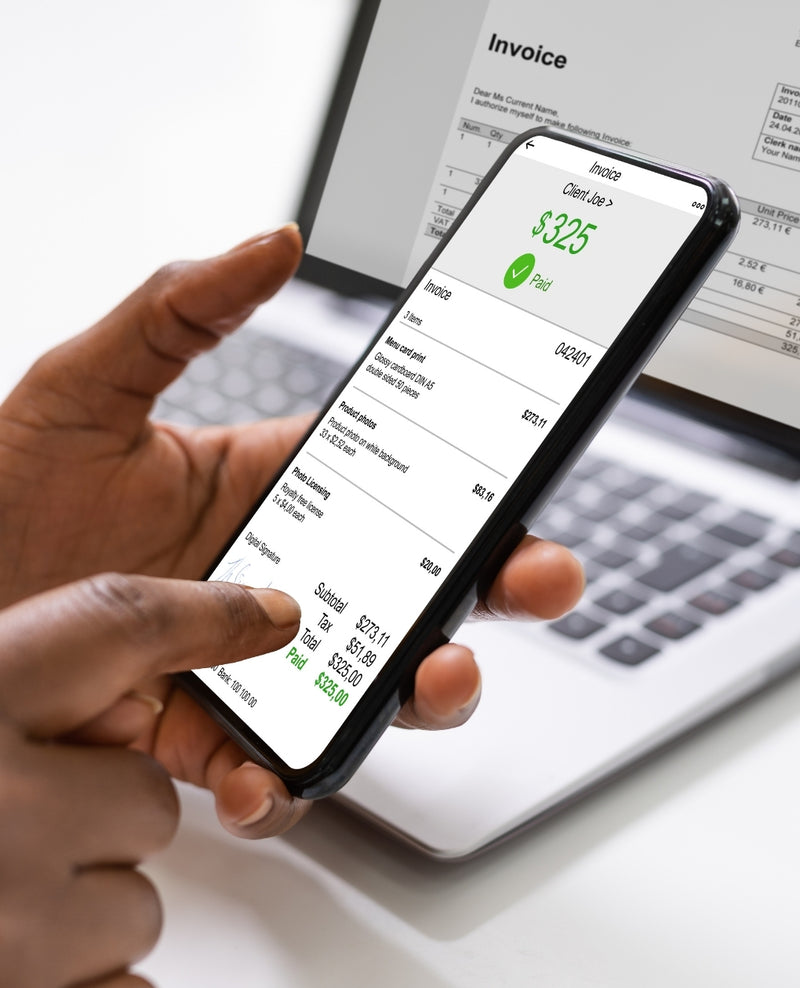

AUTOMATE SAVINGS

Set it and forget it. With $5/day automation, your savings build quietly — without lifting a finger.

GET YOUR AI PLAN

Want to save $500? Pay off debt? Write one goal — and get a custom 3-step AI-powered plan to achieve it.

Struggling with Money? Let AI Fix Your Finances

Get personalized daily money tips to help you budget better, build credit, and stop living paycheque to paycheque — starting this week.

What You’ll Get — Straight to Your Inbox

Bite-sized, action-packed tips tailored to your goals. No jargon. No pressure. Just progress.

Designed for Real Life in Canada

Whether you’re working, studying, or new to Canada — our tools help you finally feel in control of your money.

⭐️⭐️⭐️⭐️⭐️ Trusted by young Canadians coast to coast

Backed by real results, not hype • Trusted by students, freelancers, and 9-to-5ers • Personal finance made simple

Frequently Asked Questions

Got questions about budgeting, credit, or our 7-Day AI Challenge? You’re not alone — here are the answers young Canadians ask most.

Absolutely. Emprisaa is built for young Canadians in their 20s and 30s who are tired of living paycheck to paycheck. Our free 7-Day AI Money Booster Challenge gives you a daily action plan — no spreadsheets, no jargon. Just clarity.

It’s a free email-based challenge that delivers one small financial task each day — powered by AI. You’ll learn how to track spending, budget smartly, cancel hidden costs, improve credit, and automate savings — all in under 5 minutes a day.

Nope. We made this for people who feel financially overwhelmed. Whether you’re a student, desk worker, or gig worker — we walk you through every step using tools like Wally, KOHO, ChatGPT, and Borrowell. You just follow along.

Yes — 100% free. We make money later through digital tools and partnerships, but the challenge itself is all yours. No credit card needed. No upsells. Just results.

Definitely. Each task takes about 3–5 minutes. It’s designed for busy professionals, parents, students — anyone who feels like they “never have time” for their money.

AUTOMATE YOUR BUDGET. BUILD CREDIT. SAVE SMARTER. — ALL WITH AI

Your personal AI financial planner – now in your inbox.